Trust shouldn’t be trapped

Every compliance solution in the market was built with the same assumption: institutions only look inward. The result is an industry where checks are duplicated, processes drag on, and trust gets stuck inside silos.

This makes compliance feel heavy and redundant, raising costs, slowing decisions, and breaking the promise of real-time finance.

Trust that travels

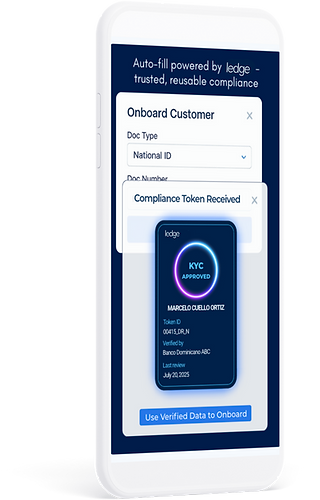

ledge introduces the Compliance Passport: a living digital token that carries verified KYC/AML data and risk intelligence, moving seamlessly across banks, borders, and partners.

One-time verification. Endless reuse.

Always alive. Continuously updated, AI-scored, and auditable in real time.

A new channel of trust. Customers create updates with every interaction; institutions can prompt, verify, and resolve compliance directly through the passport.

Smarter together. Each institution adds to a shared network of risk intelligence.

Trust that compounds. Every check becomes an asset: cutting costs, raising standards, and strengthening the entire financial ecosystem.

Trust takes form

One network. One passport. A single standard of trust.

For Institutions

Faster onboarding, lower costs, and continuos monitoring through every customer interaction.

For Regulators

Continuous, cross-border visibility, not static reports.

For Customers

Less friction, faster access, and full control and consent over their data.

Redefining trust in global finance

With ledge, compliance shifts from a cost of doing business to the engine of financial confidence: reducing country risk through measurable trust, strengthening defenses against financial crime, and unlocking capital flows with faster, interoperable verification.

ledge is the force that makes trust move markets.

Book your demo today.

Be part of the future of compliance